Understanding Personal Injury Protection Insurance

A robust auto insurance policy helps minimize a driver’s anxiety. Whether you find yourself navigating unfamiliar backstreets or country roads, or just jostling through the frantic push and pull of highway traffic, the knowledge that your property is protected in the event of an unfortunate accident allows you to drive with confidence. PIP, or personal injury protection, is a kind of automobile insurance that provides financial protection for you and your passengers in the event of an accident, regardless of who is at fault. PIP is not mandatory in Virginia or Washington DC, but is mandatory in Maryland. Understanding PIP can be invaluable in protecting yourself and your loved ones. In today’s blog post, we’ll explain PIP, as well as how it may protect you in the event of an accident.

What is Personal Injury Protection Insurance?

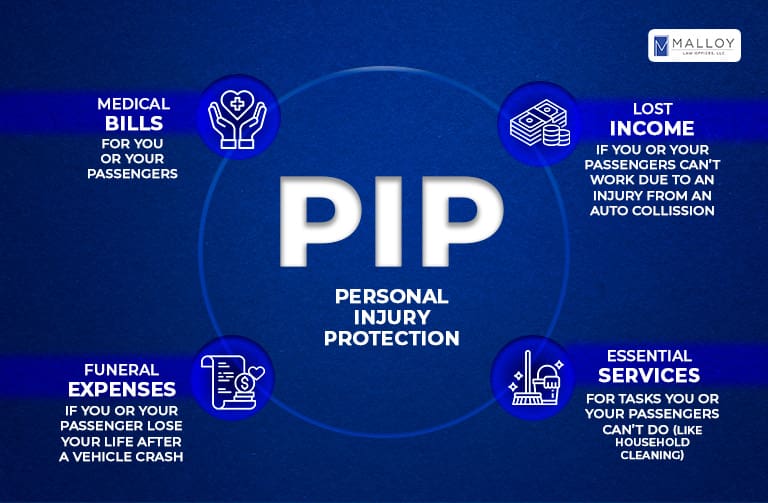

Personal injury protection insurance, often referred to as “no-fault insurance,” is designed to cover medical expenses, lost wages, and other related costs resulting from injuries sustained in a car accident. Unlike liability insurance, which only covers damages to the other party, PIP covers expenses for you and your passengers, regardless of who caused the accident.

How Does PIP Work in the Event of an Accident?

In the unfortunate event of a car accident, personal injury protection insurance kicks in immediately to cover medical expenses for you and your passengers, up to the policy’s limit. This includes costs such as:

- Ambulance Fees

- Surgical Costs

- Hospital Bills

- Rehabilitation and Therapy

- Funeral Expenses

- Survivors’ Benefits

- Replacement Services in the Event of a Disability

Additionally, PIP may also provide coverage for lost wages if you are unable to work due to injuries sustained in the accident.

Why is Personal Injury Protection Insurance a Worthwhile Investment?

One of the key advantages of PIP is its promptness in providing coverage. Unlike liability claims, which can take time to determine fault and process payments, PIP benefits are typically paid out quickly, allowing you to receive the necessary medical treatment without delay.

Investing in personal injury protection insurance offers several benefits that make it a valuable addition to your auto insurance policy:

Comprehensive Coverage: PIP provides broad coverage for medical expenses and lost wages. This ensures that you and your passengers receive the necessary care and support following an accident.

No-Fault Coverage: With PIP, you don’t have to worry about proving fault. There’s no lengthy legal battles to receive compensation. Regardless of who caused the accident, PIP steps in to provide coverage for your injuries.

Peace of Mind: Knowing that you have financial protection in place can provide peace of mind. This is especially true in high-stress situations such as car accidents.

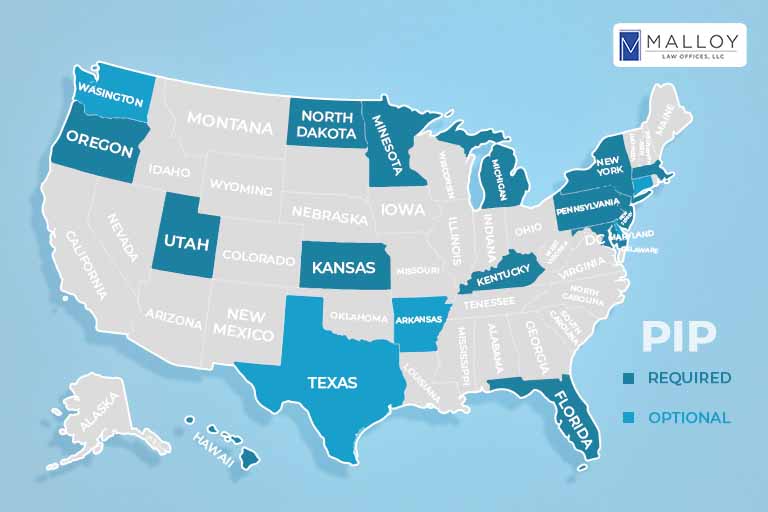

Legal Requirements: In some states, personal injury protection insurance is mandatory. This means that you are required by law to carry this coverage. Even in states where it is optional, the benefits of PIP make it a worthwhile investment for many drivers.

In conclusion, personal injury protection insurance offers essential coverage for you and your passengers in the event of an accident. By providing prompt and comprehensive benefits, PIP ensures that you can focus on recovery without the added stress of financial burdens. Whether it’s required by law or optional, investing in PIP can provide invaluable protection and peace of mind on the road.

If You’re Involved in a Car Accident

If you’re involved in a car accident, PIP can be invaluable in providing short term relief. But it can only go so far. PIP will not cover the damage to your vehicle and other property. The amount of coverage is also finite. You may end up paying for damages beyond a certain dollar amount yourself.

If you’ve been involved in a car accident, you owe it to yourself to explore any and all avenues to claim compensation. While PIP benefits can be a serious source of relief, you may still be able to claim further compensation for loss of property as well as pain and suffering. Malloy Law Offices is home to DC, Maryland, and Virginia’s car accident specialists. Our experienced and diverse team has the know-how to craft a winning strategy unique to your situation. Contact Malloy Law today for a free consultation and let’s win your case.